411.1 Policy

Trustees and the administration acknowledge that certain travel is essential to the mission of the College. Therefore, employees, students and certain other individuals may be authorized to travel on official business for the College. If prior approval is obtained through established procedures, authorized travelers may submit a claim for reimbursement of allowable travel expenses.

The travel policy and procedures shall apply regardless of the source of funds used for reimbursement or if there is no reimbursement.

The College reserves the right to adjust the reimbursement procedures and rates, including reducing reimbursements depending on budgetary constraints.

411.2 Procedures

It is the traveler’s obligation/responsibility to read and understand the travel policy and procedures.

Travelers shall follow applicable College, local, state and federal policies, procedures and regulations and shall represent the College with decorum and in an appropriate and professional manner.

Travelers are expected to use the most economical means of travel that are reasonable and practical. Unnecessary and extravagant expenses may not be reimbursed.

Travel procedures shall be maintained and updated at least annually, as needed, to conform to industry rates and standards.

Categories of travel and travelers may include but are not limited to Employee Travel, Non-employee Travel and Student Travel.

All Travelers traveling beyond the Local Vicinity Area who will incur a cost or reimbursement, are required to complete a Travel Authorization Form. A Travel Authorization form shall be completed prior to the travel, approved by the traveler’s immediate supervisor and turned into the Procurement Services Office. Any agenda or schedule associated with the travel must be included with the submission of the Travel Authorization form. A Travel Authorization form may be obtained from the CEI HUB. Failure to complete the required documentation and receive appropriate approvals before travel could result in not being granted a reimbursement as well as disciplinary action. The traveler is encouraged to keep a record of scheduled travel.

Normally, if another agency, professional organization, corporate sponsor, etc., will be reimbursing travel expenses, documentation from that sponsor must be obtained and attached to the Travel Authorization form when submitted for approval. If a third party reimburses a traveler for expenses after the traveler has requested and received reimbursement from CEI, the traveler must repay CEI the lesser of (1) the total paid by the third party or (2) the total amount reimbursed to the traveler by CEI. It is the traveler’s responsibility to initiate the reimbursement and to ensure that any and all funds are remitted to CEI.

Definitions

Employee Travel

- Local vicinity travel – leaving from and returning to one’s duty station by the end of the day.

- In-state, overnight travel involving two or more days.

- Out of state travel, whether for a single day or for multiple days.

- Travel in the regular line of duty such as recruiting or attending official meetings or events.

- Travel for professional development.

Non-employee Travel

- Travel by non-employee representatives of the College such as Board of Trustee Members or independent contractors as allowed by signed contract.

- Travel by job candidates invited to campus for interviews and tours.

- Travel by guests, such as speakers.

Student Travel

- Student travel relating to student activities and course work

Traveler: the traveler is an individual that is an employee, Board of Trustee, or independent contractor (as allowed by signed contract) representing the College of Eastern Idaho.

Official Workstation: the primary work location assigned to the traveler, or the location where the traveler works from most frequently.

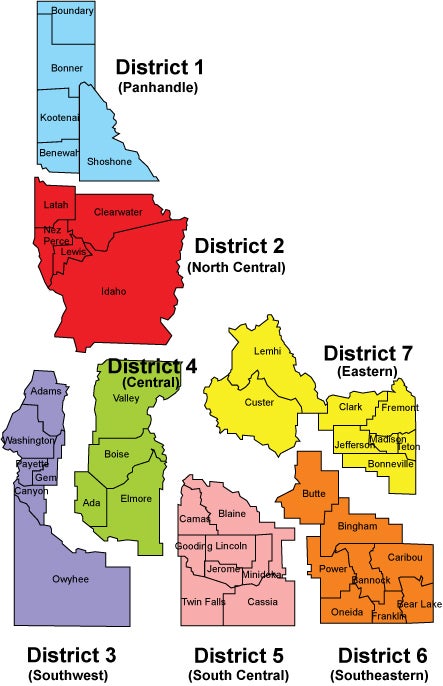

Local Vicinity Travel: travel time that occurs between 7:30 a.m. and 5:00 p.m. The local vicinity travel area is defined as District 6 and District 7, as per Exhibit B (see page 10).

Meal Per Diem: the daily reimbursable amounts for meal and incidental costs. The Per Diem amount covers meals, meal gratuities, fees.

Approver: person(s) responsible for a budget or funding that is given the authority to manage and monitor those expenses and the manager of the employee that is responsible for approving the employee’s leave.

Travel Authorization Form: the form is the official request to travel with the appropriate authorizing signatures. The form is required to be completed if the following information exists:

- The travel will incur any costs (except fuel for a CEI vehicle) or reimbursements.

- The travel times and distance will exceed the local vicinity travel stipulation.

- The travel will be out of the state of Idaho.

Travel Expense Report: the report is a form that the summary of travel expenditures is listed and a request for the traveler to be reimbursed for travel related expenses.

P-Card: a CEI credit card that is issued to employees. See Policy 215: Commercial (Purchasing) Card

Guidelines

The most safe, practical, and economical means of travel must be used. If not, transportation means may be revised. This may include the option of sharing a ride with other travelers when possible, renting a vehicle instead of mileage allowance or flying instead of driving.

- Transportation – Travelers shall use the most cost-effective and efficient mode of travel. Exceptions to this requirement may be allowed due to usual or unforeseen circumstances that are properly documented and approved by the supervisor. Supporting documentation must be attached to the travel request.

- Airfare- Travelers are expected to book the lowest most economical airfare (note: ticket prices change rapidly and may need to be adjusted if reservations are not made in a timely manner). First class and business class upgrades are not allowable expenses. One baggage charge each way are an allowable expense.

- CEI owned vehicles are the preferred mode of travel. The CEI vehicle is to be used for CEI business purposes only. Fuel charges are to be charged on the fuel card located with the vehicle key.

- Rental Vehicles – The rental option must be compared to all other modes of transportation. The use of a rental car must also be included in the travel expense report if travelers are flying to their destination and requesting a rental car and/or other mode of transportation while at their destination. CEI has preferred vendors for vehicle rentals. Travelers should contact the Procurement Services Office for the name and account numbers. Travelers should deny the insurance coverage associated with the rental of a vehicle. CEI will provide the insurance that will cover the cost of an accident unless malicious intent on the part of the traveler is determined.

Charging the rental and fuel costs to the traveler p-card is acceptable.

- Personal Vehicle – This is not a preferred or recommended method. However, if no other means of transportation are available, then use of a personal vehicle may be authorized at the convenience or discretion of the College. The employee must accept to use their personal vehicle. In this situation the employee may be reimbursed at the full-allowable rate as listed on Exhibit A (see page 9). This situation requires additional approval of the Vice President of Finance and Administration by obtaining a signature or initial on the Travel Authorization form.

Note: While this is discouraged, travelers may opt to use their personal vehicle in-lieu of a CEI vehicle for their personal convenience. The reimbursement rate will be one-half of the full mileage rate as listed on Exhibit A. This option must have prior approval on the Travel Authorization form.

When approved and using a personal vehicle:

-

- The driver must have a valid driver’s license and the use of a seat belt is mandatory for all passengers.

- The traveler must use his/her personal automobile insurance while driving on official CEI business.

- Allowable mileage is computed according to any reputable on-line map software (Google Maps or MapQuest). Odometer readings are acceptable only when mileage computations cannot be made from such maps or charts. When using this method, the beginning and ending odometer readings must be listed on the Travel Expense Report.

- Charges for repairs, tires, gasoline, and other operating expenses will not be separately reimbursed and are considered part of the mileage rate.

- The use of the traveler P-card for fuel and/or other personal vehicle related expenses is not acceptable.

- Lodging – Travelers should endeavor to secure the most economical and practical lodging possible. Travelers should identify themselves as an employee of CEI to obtain a government rate and a sales tax exemption (if hotel allows).

-

-

- The lodging sales tax exemption certificate (CEI ST-104) can be found on the CEI HUB.

- Charging the lodging cost to the traveler p-card is allowable. If a CEI issued p-card is not available, a copy of an itemized hotel receipt is required for reimbursement (original should be submitted with p-card expense report).

- Lodging provided by relatives or other individuals is not an allowable expense unless they are in the business of providing such services which are publicly advertised and a formal invoice is provided.

-

-

- Meal Reimbursement – A daily Per Diem allowance shall be paid to the traveler in accordance with the amounts and hours of the day as established by the federal Per Diem policy that can be found on the GSA.gov portal, https://www.gsa.gov/travel/plan-book/per-diem-rates. Travelers are not required to submit meal receipts; instead the traveler is reimbursed based on the rates applied to the location, time and length of the travel. Incidentals (tips, baggage carriers, hotel staff, etc.) are included in the daily per diem rate, see Exhibit A. The traveler must indicate on the Travel Request the number and breakdown of meals needed. A copy of a meeting or conference agenda must be attached to the Travel Request showing the number of meals provided.

- Travelers using a CEI P-card may not charge meal expenses to the card.

-

- Meal Per Diem will be reimbursed based on the following departure and arrival times:

-

Breakfast: if the actual departure time is 7:00 a.m. or before, or if the return time is 8:00 a.m. or after.

Lunch: if the actual departure time is 11:00 a.m. or before, or if the return time is 2:00 p.m. or after.

Dinner: if the actual departure time is 5:00 p.m. or before, or if the return time is 7:00 p.m. or after.

- The travel departure and return times must be recorded to account for meals that are being claimed.

- Departure time: arrival time at the airport (not to exceed 120 minutes before the flight). If traveling by other means, it is the actual departure time from home or work.

- Arrival time: If air travel, it is the airline arrival time. If the traveler is using a rental car, it is the time that the rental is returned to the rental company. If traveling by personal or CEI vehicle it is the time that the traveler arrives back at work or if after business hours, the time that the traveler arrives home.

- The approved Per Diem rate must be listed on the travel request.

- Complimentary meals, including continental breakfasts provided by a hotel and meals provided by common carriers, will not be deducted from the Per Diem allowance to be paid. However, full meals included as part of a conference or meeting registration fee must be deducted from the per diem allowance.

- If traveling to a different state, the total Per Diem rate will be calculated as follows:

20% for Breakfast, departure time is 7:00 a.m. or before, or the return time is 8:00 a.m. or after.

30% for Lunch, departure time is 11:00 a.m. or before, or the return time is 2:00 p.m. of after.

50% for Dinner, departure time is 5:00 p.m. or before, or the return time is 7:00 p.m. or after.

Travel Reimbursement - Any expenses that can be pre-paid such as airfare, conference registration and lodging charges should be completed before travel. In reviewing travel expense reports, CEI reserves the right to change or ask for additional information. Purchasing cardholders are encouraged to use their P-card or a department p-card for travel expenses with the exception of meals and fuel to the extent possible. Retain receipts for all P-card charges as well as original receipts for travel by common carrier, long term parking, vehicle rental, charter, and all lodging. The traveler may request a limited advance of funds for meal per diem and/or estimated mileage expense prior to departure. Requests for an advance must be requested through the traveler’s immediate supervisor and will be done by the Procurement Services Office. The Procurement Services Office must have paperwork at least 10 days prior to departure date.

Allowable travel expenses include but are not limited to:

- Expenses for airline, lodging, rental car, fuel for rental car.

- Taxi or public transportation fares to and from depots, airports and hotels for business purposes.

- Parking fees.

- Airline baggage fees for one bag, each way.

- Charges for transportation, handling and storage of CEI equipment and/or promotional materials necessary for the event.

- Registration, conference and workshop fees.

- Expenses for all other items not described that are necessary for official CEI travel provided there is an approved business purpose for the expense.

Personal expenses not eligible for reimbursement include but are not limited to:

- All expenses of a personal nature incurred solely for the convenience of the traveler such as but not limited to expenses for meals included in the cost of registration or provided by the event, room service, entertainment, or alcoholic beverages, late check out fees, lost or stolen cash or property, etc.

- Expenses incurred for a traveler’s commute from home to their official workstation.

- Expenses incurred while on personal leave even if it is scheduled in conjunction with CEI-sponsored travel.

- Airfare obtained with frequent flyer miles or credit programs, travel vouchers, credits, gift cards or any other non-monetary programs.

- Costs paid by direct billing, a third party, or another traveler.

- Reimbursement requests must be processed and adhere to the following:

- If the prior approval is undervalued by more than 20% of the actual travel expense, or if actual travel deviates significantly from the authorized plan, a written explanation is required.

- Travelers must submit requests for reimbursements with approvals and all supporting documentation within thirty (30) days of completion of travel. No reimbursements will be granted without all appropriate documentation and approvals submitted to the Procurement Services Office. Receipts are required for all expenses except Per Diem.

- After thirty (30) days have passed without a request, CEI reserves the right to deny expense reimbursement.

- Third Party Reimbursements:

- Travelers are not eligible for reimbursement from CEI when a third party intends to reimburse the traveler. Traveler must still submit a Travel Authorization form with identifying the third party will reimburse expenses prior to traveling.

- Travelers may only submit allowable travel expenses not covered by the third party.

Non-Employee Travel (Includes Board of Trustees)

In limited instances, non-CEI employees may travel at the sponsorship of CEI. Non-CEI employees must follow the same process as CEI employees for travel, including obtaining prior approval. In some instances, they will be eligible for the CEI allowable travel expenses. Any additional expenses outside the allowable expenses will require pre-approval.

Student Travel

Student Field Trips and Clubs Travel (Day Trip)

Eligible travel purpose must be related directly to a class or club purpose. Only full-time CEI employees may accompany students on a trip and must follow the guidelines for CEI Employee Travel. Students must completely fill out the required document for approval before departure. The Student Travel Authorization Form must be pre-approved by the appropriate Dean, Dean of Student Affairs and the Vice President of Academic and Student Affairs before making any travel commitments or arrangements.

Additional guidelines for student travel include the following:

- Emergency contact information must be provided for each student traveling.

- A parent or guardian’s signature is required if the student is under eighteen (18) years of age.

- Students must be healthy enough to attend the trip and may be asked for a physician’s approval.

- Students traveling on behalf of CEI must provide their own health and injury insurance coverage.

- Employees cannot drive a student in their personal vehicle to the destination. Similarly, students cannot drive employees in their personal vehicle.

- If students are driving their personal vehicles to a CEI-sponsored outing, they must provide proof of a current driver’s license and insurance.

- Students and employees will be held responsible for reviewing and adhering to the Code of Conduct for CEI.

- No Per Diem or incidentals will be given to either employees or students as defined under Local Vicinity Travel.

- Students do not qualify for mileage reimbursement.

Student Overnight Travel

- Eligible travel must be related directly to a class or club purpose.

- Students must have qualified for off-campus competitions to be eligible for CEI sponsored travel.

- Only full-time CEI employees may accompany students on a trip and must follow the CEI Employee Travel policy.

- A recommended ratio of employee to students for overnight travel is one employee to every ten students.

- An emergency plan must be submitted with the prior approval forms.

- Students must completely fill out the required document for approval before leaving for the trip. All paperwork must be pre-approved by the appropriate Dean, Dean of Student Affairs and the Vice President of Academic and Student Affairs before making any commitments or arrangements.

- A completed CEI Student Travel Waiver and Release form including emergency contact information for the student is required.

- A parent or guardian signature is required if the student is under eighteen (18) years of age.

- Students must be healthy enough to attend the trip and may be asked for a physician’s approval.

- If using club or sponsor funding for the trip, a plan to cover any shortages must be presented with the pre-approval forms.

- Departments and clubs must have funds available before making arrangements for the trip.

Per Diem for Student Travel

- Club or college funds cannot be used for spousal or family travel expenses.

- Student meal reimbursement will be determined by the Student Life and Student Affairs.

- Students do not qualify for incidentals.

- Per Diem rate must reflect any meals provided at the event and will be prorated accordingly.

- No alcohol may be purchased with any college or club funds.

- Sales tax is reimbursable for meals and rental cars. Sales tax exemption should be requested at the hotel but if the hotel does not allow, the sales tax will be reimbursed. All other expenses with sales tax charged are not reimbursable.

Accommodations for Student Travel

- Employees and students are prohibited from sharing a room in any situation.

- Students will share a room with a minimum of two to a room.

- Students and employees will be expected to cover all expenses of a personal nature incurred solely for the convenience of the student or employee such as but not limited to meals included in the cost of registration or provided by the event, room service, cancelation charges, alcoholic beverages, late or early check in/out fees, lost or stolen cash or property, etc.

Exhibit A

Mileage Reimbursement and Meal Per Diem Rates

- Mileage Reimbursement:

Current Rate as of January 1, 2024 as per GSA.gov:

Use of Private Vehicle / CEI Vehicle is unavailable $0.67

Use of Private Vehicle / Personal Convenience $0.34

- Meal Reimbursement:

Meal and Incidental Per Diem for the period of October 2023 – September 2024 as per GSA.gov (Link: https://www.gsa.gov/travel/plan-book/per-diem-rates):

State of Idaho – If City/County is not lot listed, use the Standard Rate

|

Destination |

County |

Daily Per Diem |

Breakfast |

Lunch |

Dinner |

|

Standard Rate |

|

$59.00 |

$11.80 |

$17.70 |

$29.50 |

|

Boise |

Ada |

$74.00 |

$14.80 |

$22.20 |

$37.00 |

|

Sun Valley |

Blaine/Elmore |

$74.00 |

$14.80 |

$22.20 |

$37.00 |

|

Coeur d’Alene |

Kootenai |

$64.00 |

$12.80 |

$19.20 |

$32.00 |

- Meal Reimbursement Example:

- Employee travels to a one-day meeting in Twin Falls and the host is providing lunch. The employee laves the Official Workstation at 6:30 a.m. and returns to the Official Workstation at 7:30 p.m. The employee is allowed reimbursement for breakfast ($11.80) and dinner ($29.50).

- Employee travels to a one-week conference in Salt Lake City, Utah that begins at 8:00 a.m. on a Monday and ends at 2:00 p.m. on a Friday. The conference registration includes the cost for lunch on Monday and Wednesday and the cost for dinner on Wednesday and Thursday. The employee leaves the Official Workstation on Sunday at 4:00 p.m. and returns to the Official Workstation on Friday at 7:00 p.m.

- According to the GSA.gov, the Salt Lake City, Utah Per Diem rate is $64.00. The meal breakdown is: 20% Breakfast: $12.80; 30% Lunch: $19.20; 50% Dinner: $32.00.

The employee is allowed meal reimbursement for a total of $249.60

|

|

Sunday |

Monday |

Tuesday |

Wednesday |

Thursday |

Friday |

|

Breakfast |

|

$12.80 |

$12.80 |

$12.80 |

$12.80 |

$12.80 |

|

Lunch |

|

Conference |

$19.20 |

Conference |

$19.20 |

$19.20 |

|

Dinner |

$32.00 |

$32.00 |

$32.00 |

Conference |

Conference |

$32.00 |

Exhibit B

Local Vicinity Travel Areas